India is the home to a remarkable 8% of the world’s recorded flora and fauna with only 2.4% of the world’s total land area. The nation’s landscape hosts a vast and variety of agro-ecological diversity, ranging from humid and dry tropical in the south to temperate alpine climates in the north. This inherent natural wealth has made agriculture beyond livelihood, making it a way of life. It is, therefore, not astonishing to notice that ~70% of the nation’s populace is intertwined with agriculture and its allied sectors. This underscores the organic evolution of agriculture, transforming it from a mere profession into an integral part of our natural response to the environment.

While agriculture currently contributes 18.3 % to the GDP (GVA as % of total economy at current prices), this percentage is diminishing due to multiple reasons. Concurrently, the rate of urbanisation increased by 3.3% in the last decade and is expected to increase further too. This provides an opportunity for the entire agriculture sector to rapidly scale up production despite its own challenges, thereby contributing to the sectoral GDP. The agriculture sector becomes indispensable in meeting the escalating food demand too. This signifies and reiterates the need to pivot from subsistence farming to a more commercial approach, to increase food production and sustain food security. Critically speaking, this agricultural transformation is poised to address the mounting global and local demands.

The primary obstacle facing numerous dedicated efforts aimed at agricultural advancement, particularly for the average Indian farmer with a modest landholding of 1.08 hectares, is the persistent lack of capital. Agriculture commodity prices exhibit volatility and unpredictability, and the returns generated are often insufficient to independently finance the adoption of new technologies. Furthermore, any investment in fixed assets entails its own breakeven time, while farming activities necessitate continuous expenditure on seeds, fertilizers, manure, machinery rentals, and labor. Despite commendable contributions from governments and other stakeholders in providing technology, inputs, and diversification opportunities, the agricultural sector struggles to gain substantial traction on the ground. To surmount this challenge and catalyze progress, there is a crucial need to enhance credit linkage to farmers, enabling them to seize the multitude of opportunities for advancement.

Efforts and initiatives

Boosting the agricultural sector's performance requires the establishment of strong credit links for the majority of rural contributors to the economy. The government has put its foot in trying to solve the gap in credit delivery through various initiatives. Some of them are listed below

- Credit Guarantee: To mitigate the risks associated with lending, the government offers credit guarantees, providing a financial safety net for lenders. Schemes like AIF, AHIDF, etc., incorporate a credit guarantee component to encourage financial institutions to extend credit to segments and projects considered to be high risk.

- Interest Subvention Schemes: To make credit more affordable and alleviate the financial burden on farmers, the government provides interest subvention by subsidising interest rates. This initiative also aims to shift credit from the informal sector to the formal sector and protect farmers from exploitation.

- Financial Inclusion: In recent years, significant attention has been directed towards enhancing access to credit institutions. Initiatives such as no-frills accounts, as exemplified by schemes like PM-Jan Dhan Yojana, have successfully contributed to fostering greater financial inclusion.

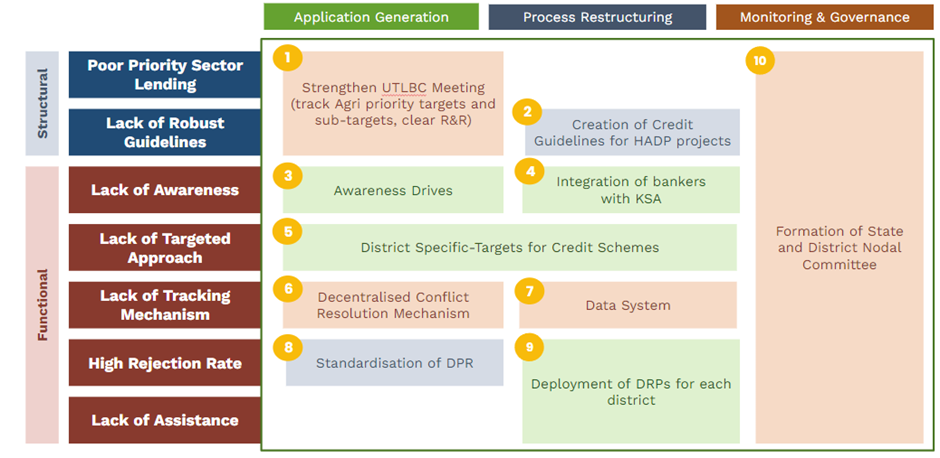

Despite ongoing efforts and initiatives, certain factors consistently impede these endeavours, resulting in limited success in implementing credit-linked schemes and policy initiatives. These challenges can be broadly categorized into two main groups.

Structural Issues

Issues classified as structural problems necessitate more extensive policy changes and improved information symmetry. These problems have a larger impact at the macro level, affecting the overall efficiency and effectiveness of credit delivery systems. Tackling these structural challenges requires a comprehensive approach that can address systemic issues and promote equitable access to credit. This involves measures to enhance financial inclusion, ensure fair lending practices, and foster a more transparent and responsive financial ecosystem. By addressing these fundamental issues, the agricultural sector can receive the necessary financial support to thrive and contribute significantly to the nation's economy. Some of the key structural problems are mentioned below

- Adherence to policy guidelines - As per the RBI guidelines, Domestic Scheduled Commercial Banks are required to lend 18% of the Adjusted Net Bank Credit (ANBC) or Credit Equivalent to Off-Balance Sheet Exposure, whichever is higher, towards agriculture. A sub-target of 8% is also prescribed for lending to small and marginal farmers (SF/MF) including landless agricultural labourers, tenant farmers, oral lessees, and sharecroppers. Similarly, in the case of Regional Rural Banks, 18% of the total outstanding advances is required to be towards agriculture and a sub-target of 8% has been set for lending to small and marginal farmers. While these directives by RBI are intended to address the gaps in credit delivery to the poorest farmer, the gap in equitable distribution of benefits across the country remains a challenge. At the national level, non-priority sector lending tops the charts as far as credit disbursement is concerned. Currently, Only 37% of the target credit amount has been disbursed for agriculture priority sector lending in J&K, while non-priority sector lending is 141% of the targeted amount.

- Absence of alternative banking systems - The absence of alternative banking systems is a significant concern in India. Scheduled Commercial Banks play a predominant role in disbursing loans throughout the country, with around 80% of loans in schemes like AIF being contributed by them. However, it's crucial to introduce other financial institutions such as Regional Rural Banks (RRBs) and Credit Cooperative Societies to diversify risk and improve accessibility, especially in remote areas. RRBs and Credit Cooperatives currently contribute about 19% of loans in the AIF scheme. These institutions also enhance accountability and promote citizen ownership in theory. Currently, the UT has only 0.3% of credit cooperatives in the country and there is a dire need to strengthen alternative banking institutions.

- Information asymmetry regarding informal credit - Although lending from formal and regulated financial institutions has made progress, challenges persist in the form of informal credit systems. This is particularly evident in agriculture, where credit-commodity linkage remains a prevalent method of lending, often on mutually agreed terms. As a result, the penetration of formal credit institutions takes a backseat in many cases. This situation also poses a unique challenge to formal institutions when assessing the credit risk associated with new borrowers who lack formal credit history but may have informal credit arrangements. This scenario leaves room for decentralised institutions to assign values to information based on potentially biassed data gathered from local sources. Addressing this complex issue requires a multi-faceted approach that starts with eliminating informal moneylenders who often charge exorbitant interest rates and aims to establish formal institutions as the preferred choice for borrowers.

As explained earlier, addressing structural challenges requires sustained and focused initiatives over extended durations. Guided by GDi’s commitment to constructing systems and adopting a systemic thinking approach, we have developed a supportive framework that can facilitate improvements in the broader credit landscape through essential policy adjustments and structural reforms

Creation of a decentralised conflict resolution mechanism

In order to inculcate a degree of shared accountability with external stakeholders like financial institutions and the UT, a decentralised conflict resolution mechanism has been designed. This would enable applicants to reach out to nominated District Resource Persons (DRPs) at any point of time to resolve and escalate conflicts that arise in the process of availing credit.

Committee for agriculture credit

While the UTLBC (Union Territory Lending Banks Committee) oversees lending in the Union Territory across all sectors, there is a pressing need to specifically address credit linkages in the agriculture sector on a more regular basis. Policy changes require thorough deliberations and discussions, with input from grassroots levels. Therefore, establishing a dedicated committee to oversee agricultural lending—monitoring scheme penetration, addressing disputes at the ground level, evaluating government and bank initiatives to enhance credit penetration, and devising strategies to improve credit delivery—is essential. GDi has designed the structure and working principles of a UT level committee and a sub-committee at the district level consisting of representatives from financial institutions and government’s Agriculture Production Department. This committee would serve as the implementation and strategy arm of the UTLBC, with a sole focus on the agriculture sector.

Functional Issues

Functional issues are micro in nature and have impact in the short term. Though the issues pertain to individual level, the magnitude of the problem directly affect the masses across geographies. Few examples of functional issues affecting credit delivery are mentioned below

- Lack of awareness - The lack of awareness about credit linked schemes is a significant challenge in the realm of credit delivery. This lack of awareness stems from limited access to information, financial illiteracy, and a general disconnect between financial institutions and the local population. As a consequence, deserving individuals and businesses miss out on crucial financial resources that could help them grow and thrive.

- Lack of a tracking mechanism - The absence of a robust tracking mechanism in credit-linked schemes presents a significant challenge at the micro level, sometimes at the state/ UT level. Without an efficient system in place to monitor the progress and utilisation of credit funds, it becomes challenging to assess the effectiveness of these schemes and attribute responsibilities or bring accountability into the system. In the absence of adequate tracking, it becomes challenging to measure the impact of credit schemes on the intended beneficiaries.

- High rejection rate - The high rejection rate is a spot of concern hindering the penetration of credit linked schemes in the UT. The high rejection rate is attributed to reasons like incorrect details in the DPR submitted, poor credit history, high outstanding and overdue in KCC account, lack of credibility upon verification by banks, etc. among many. Financial institutions cannot be expected to approve credit for every applicant. However, there is a pressing need to create interventions that target the specific literacy and information gaps that often undermine the intentions of potential beneficiaries and incorrectly label them as ineligible.

In order to effectively address the structural issues and create impact at pace and scale, various initiatives have been designed by GDi in the UT of Jammu and Kashmir. Below is a summary of the designed interventions and the specific issues targeted.

Awareness Drives

A district-specific awareness campaign aimed at informing and educating the farming community has been designed. This campaign will have a primary focus on enlightening farmers about the diverse range of schemes available, their eligibility requirements, essential documentation, and the different activities they can undertake under these schemes. Rather than applying a one-size-fits-all approach, we will tailor the campaign to each district, using data such as crop types, farmer demographics, and district characteristics to prioritise and recommend the most suitable scheme for the district.

Establishment of data management unit

To counter the absence of a centralised data and data-oriented review system, a data management unit will be established and insights will be made available on public forum. This will eliminate arbitrary and subjective approaches in reviewing the different schemes and the penetration of such schemes. The data management unit will use a tech-based platform to publish insights and also aid in tracking the applications at a fixed frequency providing options to resource personnel on ground to provide updates on the progress of the application to the beneficiaries.

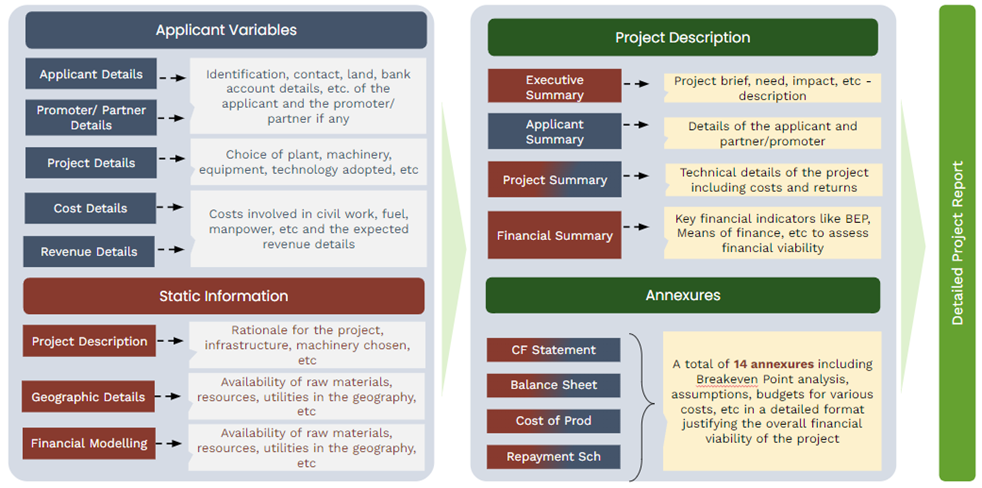

Standardisation of DPR

To address the inconsistencies in the DPR submitted during application, we have devised a standard format that could help applicants with lower levels of literacy to generate a standard DPR for their credit proposal. This initiative was undertaken with the aid of J&K Bank and the lead bank department of the UT. Key components like financial viability, cash flow projection, balance sheet, etc have been automated providing the users with ease of access and eliminating the dependence on external agents to create a DPR.

Aiding the Great Leap

Informal credit and Credit-Commodity linkage (where farmers pledge future agricultural produce to obtain short-term credit from middlemen) have been long standing practices. However, the farming community has come to realise the drawbacks of such informal arrangements after years of exploitation.

GDi team’s recent field visit to Rajouri district shows the bright side of the picture. Mr. Atul Sharma, a progressive farmer and a beneficiary of J&K Government’s flagship Holistic Agriculture Development Programme, despite facing scepticism from his village due to the unconventional nature of his plan, aspires to cultivate strawberries on his 2 kanal land. Undeterred by traditional practices, he successfully piloted this venture and is now gearing up for the next crop season with optimism about tapping into the supply market gap. Our hope is that such interventions inspire more farmers in the Union Territory to set higher aspirations and pursue them with the support of credit linkage.

The advent of digital transformation in banking systems and the increased accessibility of financial services have alleviated the concerns of farmers. Despite this positive shift, certain obstacles remain on the path to achieving the desired outcomes which we aim to solve through our strategic interventions. The government's dedicated efforts to bring financial schemes to the doorsteps of the farming community, coupled with our initiatives to bridge gaps in the Union Territory of Jammu and Kashmir, signify progress. The revolution in credit linkage and access to credit services is poised to transform the agricultural sector, and we remain committed to facilitating this positive change.