For the paddy-centric agrarian state of Punjab, managing its substantial paddy straw residue (~31 lakh hectares) is a recurring challenge annually. In earlier articles on stubble burning, my colleagues have emphasised on the critical need to tackle stubble management, providing context on why farmers resort to burning and outlining GDi's framework for addressing the issue. They also highlighted the role of Crop Residue Machinery (CRM) in addressing this issue, stressing the importance of optimal utilisation beyond mere distribution and proposing actionable measures to achieve it.

Read MoreWhile in-situ (within the field) management remains the primary approach in Punjab, supported by ~1.45 lakh CRM machines, ex-situ (outside the field) management of paddy straw is steadily gaining momentum, already covering ~2 lakh hectares as of 2024, and with a potential to cover ~10 lakh hectares by 2027. Ex situ solutions include a range of industries.

- Thermal Power Plants: Paddy straw is co-fired with coal to generate energy, using biomass pellets processed for compatibility with existing infrastructure. This United Nations Framework Convention on Climate Change (UNFCCC)-recognised technology, along with consuming stubble, reduces carbon emissions from coal-based power plants.

- Brick Kilns: Similar to thermal plants, brick kilns can incorporate biomass co-firing, replacing 30-50% of coal with paddy straw pellets, as reported in a 2015 Punjab State Council for Science and Technology (PSCST) study.

- Biomass Power Plants: Combustion technology burns biomass in boilers to generate steam, driving turbines to produce electricity.

- Compressed BioGas (CBG) Plants: Paddy straw undergoes anaerobic digestion to produce compressed biogas, a renewable energy source.

- Industrial Boilers: Industries like paper and sugar manufacturing can use paddy straw as a substitute for coal as fuel in boilers.

- Ethanol Plants: Ethanol is produced from paddy straw as a renewable biofuel.

- Pelletization: Paddy straw is densified into pellets, reducing volume while maintaining energy output. These pellets can be used for co-firing with coal in the abovementioned industries.

- Other Industries: Paddy straw can be directly utilised in producing paper and cardboard.

- Biochar: Biochar is a carbon-rich product from pyrolysis at 700-800°C under low or no oxygen, and can be made from feedstocks like eucalyptus, rice husk, bamboo, agricultural residues, manure, and organic waste. Currently, in the pilot stage.

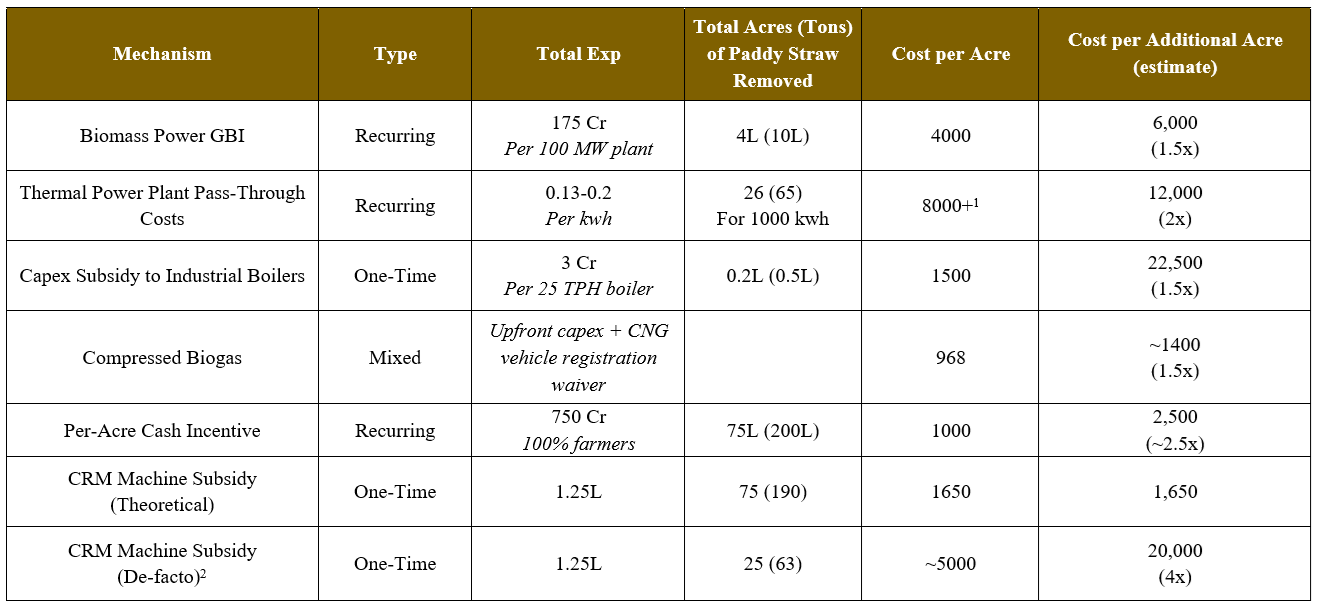

However, there are varying costs associated with each option, along with a broad set of opportunities and challenges for each. To identify the most cost-effective solution, all the ex situ initiatives must be compared based on cost to the government per tonne (or per acre) of paddy straw removed .

Keeping in mind the opportunities and challenges presented by each of the above mechanisms, the conversion of stubble into Compressed Bio Gas (CBG) emerges as the most promising innovation, signalling a move towards more sustainable residue management practices.

From Waste to Wealth: CBG's Role in a Circular Economy

Compressed Bio Gas (CBG), a refined biogas with over 90% methane content, converts organic waste into clean energy and biofertilisers, promoting sustainability. With India aiming to expand natural gas use (reflected in the government’s ₹1715 Crore investment in the National Bioenergy Program ), CBG offers Punjab a vital opportunity to transform biomass into green fuel and reduce emissions. In the CBG production value chain, feedstock (paddy straw after being baled from the field by respective biomass aggregators) is transported to the CBG plant. It is processed in a digester, where anaerobic digestion produces biogas along with a by-product, bioslurry (FOM/LFOM). The biogas is then purified and used across various applications, including CNG outlets for transportation, PNG for household and industrial use, and in some cases, for generating heat and electricity.

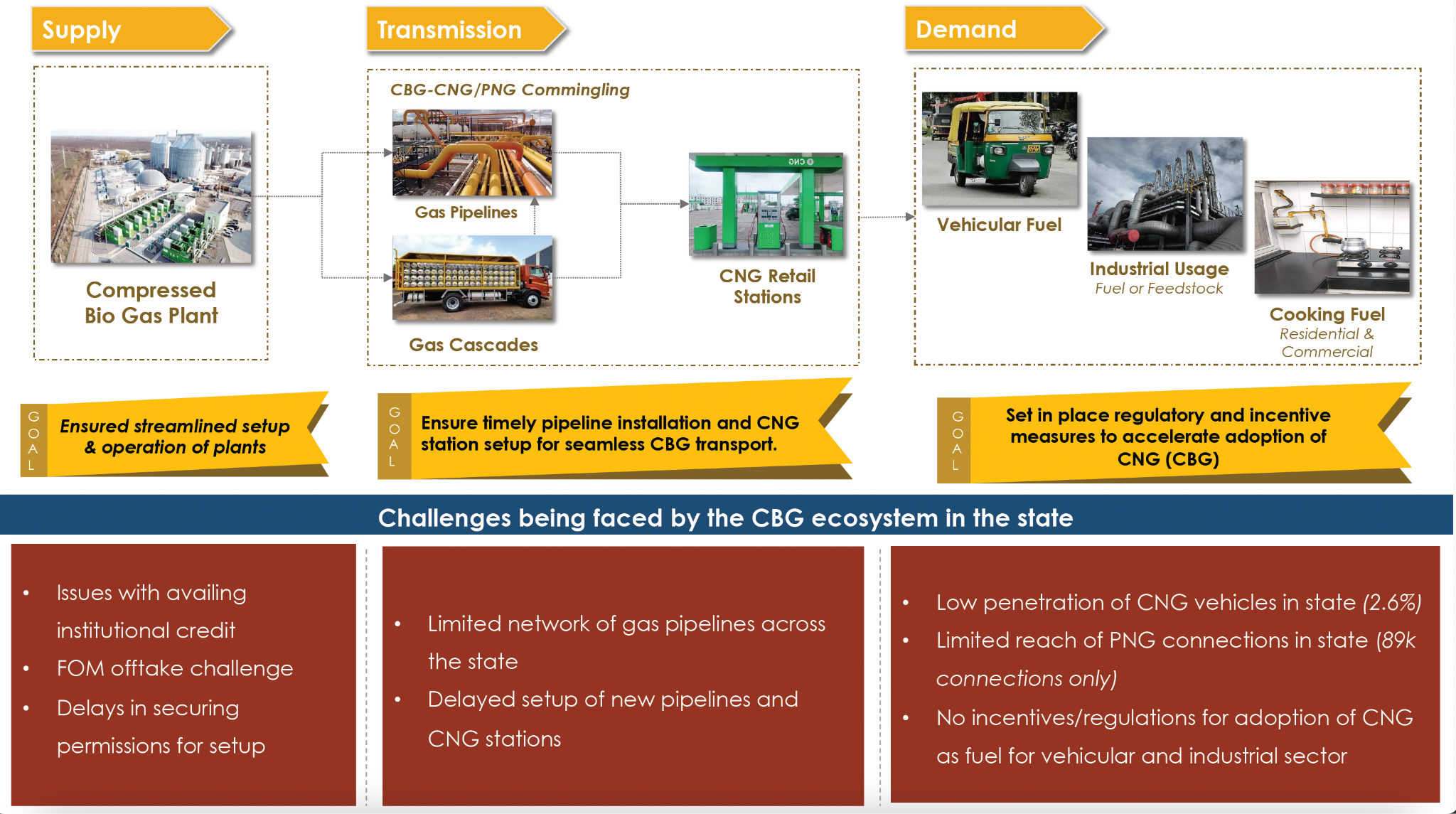

Unpacking the CBG Ecosystem in Punjab: Key Challenges and Solution Strategies

Punjab currently has four operational CBG plants, with 38 more underway and 34 proposed, collectively poised to process 30 lakh tonnes of paddy straw and consume ten percent of the state’s total production. However, this represents an ideal scenario where the plants are established on schedule and operating at full capacity. In reality, these CBG plants face several hurdles, including delays in financial closures, regulatory approvals, and post-production challenges like managing bio-manure and limited demand for CBG/CNG within the state. The low demand impacts offtake and complicates long-term agreements with Oil and Gas Marketing Companies (OGMCs). Furthermore, the transportation of CBG via cascading trucks adds to the overall costs. However, technological advancements now allow for the direct injection of purified gas into the gas grid, presenting a more cost-effective alternative for transportation.

Creation of a decentralised conflict resolution mechanism

In order to inculcate a degree of shared accountability with external stakeholders like financial institutions and the UT, a decentralised conflict resolution mechanism has been designed. This would enable applicants to reach out to nominated District Resource Persons (DRPs) at any point of time to resolve and escalate conflicts that arise in the process of availing credit.

Challenges on the supply side

- Delay in obtaining institutional credit facility: Challenges in accessing institutional credit persist for CBG projects despite their classification as Priority Sector Lending (PSL) and agricultural infrastructure by the RBI. High collateral (up to 50%) and interest rates along with extensive bank procedures deter smaller investors, delaying loans and discouraging investment.

- Delay in getting statutory approvals: Delays in statutory approvals hinder CBG plant development, requiring 15 NOCs from pre- to post-construction. While the Invest Punjab portal offers deemed approvals, unclear documentation and departmental observations often cause delays. Forest clearances, outside the portal’s scope and lacking deemed approval, have delayed projects by over two years, impacting ~34 projects in the pipeline.

- Lack of market for the byproducts: The absence of a market for FOM/LFOM, a byproduct of paddy straw digestion in CBG production, impacts both revenue and storage costs. Approximately 1.75–2 tonnes of FOM are generated per ton of straw, but much of it remains unsold or is distributed free, resulting in a 20–25% revenue loss for CBG players. Additionally, the large quantities produced pose storage challenges. To address this, the Department of Fertilizers, GoI, has introduced a ₹1,500/MT Market Development Assistance, albeit as a temporary measure.

Challenges with Transmission and Demand for CBG

- Inconsistent quality standards for CBG-CNG synchronisation: City Gas Distribution (CGD) entities cite concerns over CBG quality, including impurities that risk pipeline damage, hindering integration with CGD. While SATAT mandates adherence to IS 16087:2016 with a minimum 90% methane content, Oil Marketing Companies (OMCs) add further requirements in LOIs. For example, Indian Oil Limited’s EOI specifies CBG must be free of liquids, particulate matter, and odourized per IS 15319 for local distribution.

-

Slow progress in setting up infrastructure:

Expanding Punjab's City Gas Distribution Network (CGDN) is

crucial for maximizing CBG production and boosting the demand.

Despite PNGRB issuing LOIs to 7 CGDs for 22 districts,

implementation faces challenges:

- Non-standardized and lengthy Right of Use (RoU) application processes across authorities.

- Delays in NOC approvals, with some applications pending for over 1,000 days despite a 90-day mandate.

- Involvement of multiple departments, causing duplicated efforts and delays.

- High pipeline road restoration costs in Punjab (₹50/m with 5% annual escalation), far exceeding other states like Rajasthan and Gujarat.

- Absence of a dedicated nodal department, single-window system, or CGD-specific policy to streamline land and infrastructure allocation.

-

Inconsistent demand leading to lack of guaranteed

offtake:

The primary issue in the sector is insufficient demand,

preventing plants from scaling up. This is why OMCs are hesitant

to commit to guaranteed offtake agreements with existing CBG

plants. While CBG plants sign 15-year offtake agreements with

OMCs, banks typically require 25-year terms aligned with the

project lifespan. In practice, OMCs purchase gas based on market

demand, leaving plant owners at risk of unsold production.

- Vehicular Sector: CNG's primary consumption occurs in the transport sector, but the current CNG vehicle landscape in Punjab shows slower growth compared to the national average, with ~70,000 vehicles currently operating on CNG in the state, accounting for 0.7% of total registered vehicles in the state.

- Domestic and Commercial Segment: There are ~84,000 Domestic PNG and ~640 commercial PNG connections in Punjab, making it one of the states with the lowest number of connections compared to its neighbours (Haryana has ~3 lakh connections). The monthly increase in PNG connections remains very low (~1800 for domestic connections and ~35 for commercial).

- Industrial Segment: Currently, 275 Industries use ~7,170 tonnes (monthly average) of Natural Gas in Punjab as per the PPAC Report. Although reducing VAT on natural gas to 3.3% in 2023 has boosted CNG adoption among industries, some limitations remain.

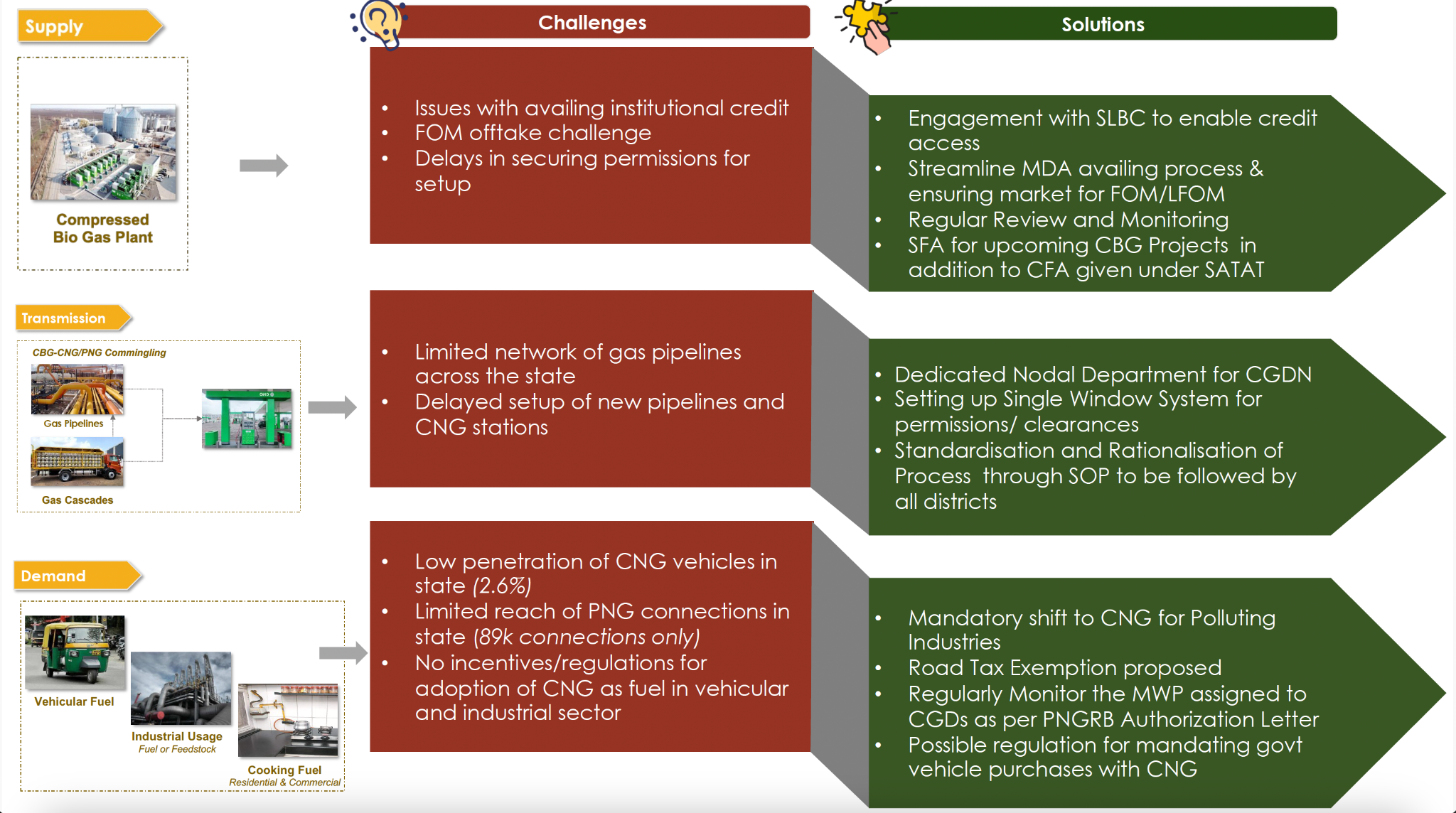

Addressing these challenges requires a unified approach from both the Government of India and the Government of Punjab

Solution Roadmap to Address State-Level Issues - For Punjab to become a leading provider of green fuel, addressing challenges in the CBG ecosystem is critical to attracting larger operators and fostering sector growth.

- Fiscal and regulatory measures: These will focus on stimulating demand in the vehicular, domestic, and industrial sectors, such as reducing VAT on CNG, prioritising CNG vehicles in public transport fleets, and incentivizing industries to adopt cleaner fuels.

- Create conducive environment for CGD infrastructure: Optimising operations to enhance demand uptake. Key initiatives include implementing a single window system for pipeline laying and CNG station approvals, streamlining the No Objection Certificate (NOC) process, and introducing a standard operating procedure (SOP) for timely and efficient application processing.

- Enhance the state's CBG ecosystem: The government should simplify the setup of CBG plants by enforcing a single window system with deemed approvals for timely NOCs and facilitating access to panchayat land for storage and plant development.

- Boost demand for organic manure: The government should aim to create market opportunities through Kisan Seva Kendras and collaborate with PAU for product fortification.

The Punjab Biofuel Policy will incorporate the aforementioned solutions, providing essential policy support. It outlines fiscal incentives and streamlined processes to expand CBG infrastructure and ensure efficient operations. Additionally, regular reviews and monitoring will be crucial for keeping projects on track and meeting deadlines.

GDi Partners has been actively supporting the Punjab Government in implementing the proposed solutions through a range of targeted interventions. These include facilitating institutional credit by engaging with banks to ensure easier access to credit, streamlining the CGD infrastructure by diagnosing existing challenges and supporting departments in implementing recommended solutions such as standardized SOPs, a single-window system, and rationalizing the departments involved in NOC issuance. Additionally, we have assisted the government in designing fiscal and regulatory incentives, including road tax exemptions and VAT reductions, by conducting benchmarking and cost analysis. These efforts aim to ensure the effective and sustainable execution of the proposed measures.

While we continue supporting the Government of Punjab in rolling out the above solutions, there are some issues which will require intervention at the national level. The following issues must be addressed to promote the growth of the CBG sector, particularly the need for long-term offtake agreements and the expansion of CGD networks:

- The Ministry of Petroleum and Natural Gas (MoPNG) is recommended to implement directives: Extend offtake agreements for 25 years to align with the project lifespan, helping CBG plants secure necessary funding.

- Expanding the City Gas Distribution Network (CGDN): This will facilitate the co-mingling of CBG and CNG, reducing reliance on cascading tanks and lowering transportation costs. MoPNG can also ensure that the CBG-CGD Synchronisation scheme is supported by long-term agreements and provide incentives for the use of decompression units to optimise the use of existing infrastructure.

- Addressing challenges related to FOM and LFOM produced from agro-waste: National-level measures to promote the sale of bio-manure alongside chemical fertilisers can support the sustainability of CBG projects.

- To ease the financial burden on CBG developers: A consultation between MoPNG and the Ministry of Finance can focus on reducing collateral requirements, as done with the Ethanol Blended Petrol (EBP) Programme.

- Rationalising the tax structure: The government might benefit from rationalising the tax structure to avoid double taxation on CBG and natural gas, and reviewing quality standards to ensure the successful integration of CBG into CGD networks.

Addressing Punjab's stubble management challenges and supporting its CBG ecosystem requires a multi-faceted approach that integrates policy reforms, fiscal incentives, and streamlined regulatory frameworks. Solutions such as CBG offer transformative potential by turning agricultural residue into green fuel, fostering a circular economy, and reducing emissions. However, overcoming supply chain bottlenecks, demand limitations, and infrastructure gaps will require collaborative efforts from both state and national governments. By implementing targeted measures, Punjab can emerge as a leader in sustainable energy while effectively managing its paddy straw residue, creating a win-win for the environment and the economy.